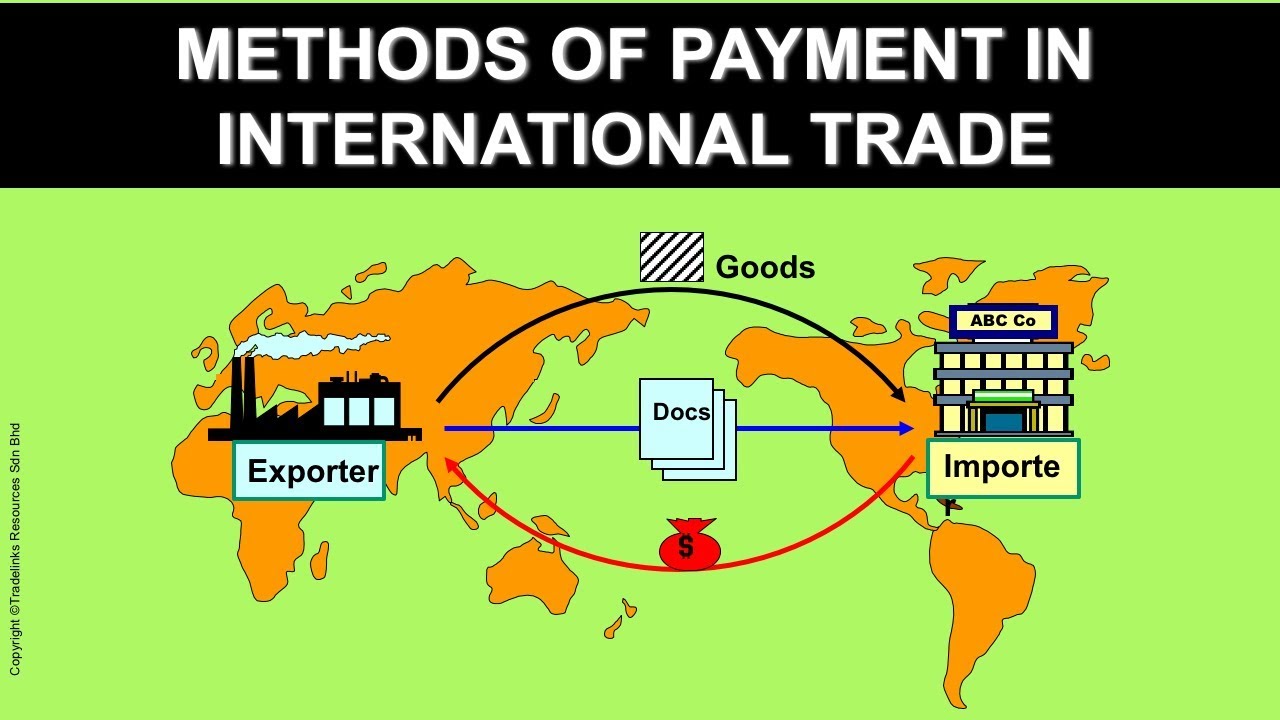

When engaging in international payment methods for trade, companies must determine the optimal payment terms to use for transactions. The chosen payment method impacts cash flow, risk, and the cost of doing business globally.

Common payment options include:

- Cash in advance

- Letters of credit

- Documentary collection

- Open account

- Consignment

There is no universally superior method. The best approach depends on factors like the importer's creditworthiness, the country involved, and the exporter's risk tolerance.

This guide covers major payment methods in international trade to help exporters and importers select appropriate terms.

Secure Payment Methods

When selling goods overseas, getting paid is not guaranteed. Exporters can minimize non-payment risks by using secure terms.

Cash in Advance

With cash in advance, the importer pays before shipment. This provides maximum protection for exporters. Payment forms include:

- Wire transfers

- Credit card payments

- Funds held in escrow

Benefits:

- Eliminates non-payment risk

- Provides cash flow predictability

Drawbacks:

- May limit sales volume

- Not ideal for importers' cash flow

Overall, cash in advance is best for first-time or risky shipments.

Letters of Credit

A letter of credit (LC) guarantees international payment methods for trade by the importer's bank once the exporter meets the LC conditions.

The issuing bank pays the exporter when documents proving shipment are presented. An advising bank verifies compliance.

Benefits:

- Payment is secure if LC terms are met

- Importers don't pay until goods received

Drawbacks:

- More complex than cash advance

- Discrepancies can delay payment

LCs add security for exporters and importers on both sides of the transaction.

For maximum payment protection, cash in advance and LCs are ideal. The additional effort is worthwhile for high-value or risky shipments.

Moderately Secure Payment Methods

Exporters seeking more favorable terms than cash in advance can consider these options that provide partial protection:

Documentary Collection / Draft

A documentary collection involves the exporter shipping goods and then submitting a draft requiring payment to collect shipment documents from their bank.

The importer makes payment to get the documents and take possession of the goods.

Benefits:

- Cheaper than letters of credit

- Goods are shipped before payment

Drawbacks:

- Risk of non-payment remains

- No payment guarantees

Overall, documentary collection offers a middle ground between security and flexibility.

Wire Transfers

Wire transfers allow direct bank account fund transfers internationally.

Benefits:

- Fast settlement

- Highly secure

Drawbacks:

- Expensive - fees range from $10-$50 per transfer

Wires are best suited for occasional high-value payments when fast settlement is needed.

Bank Transfers

Bank transfers via SWIFT allow bank-to-bank payments globally.

Benefits:

- Lower cost than wires

- Funds usually received within 5 days

Drawbacks:

- Slower settlement versus wires

- No payment guarantees

Bank transfers provide a relatively cheap option for international payments.

For moderate protection, documentary collection, wire transfers, and bank transfers offer more flexibility than secured payment methods.

Higher Risk Payment Methods

Exporters can offer buyers more attractive terms, but with higher non-payment risks. Common options include:

Open Account

With open account terms, the exporter ships goods and the importer pays later, usually in 30-90 days.

Benefits:

- Increases exporter competitiveness

- Favorable for importer cash flow

Drawbacks:

- Very high risk of non-payment

- No payment guarantees

Open account works best with established trading relationships and creditworthy buyers.

Consignment

In consignment sales, the importer pays the exporter after they sell goods to the end customer.

Benefits:

- No upfront payment required from importer

- Helps exporters access new markets

Drawbacks:

- Extremely high risk of non-payment

- No guarantees of sale by importer

Consignment is very risky but can help exporters enter competitive markets.

Trade Credit

Trade credit provides importers with extended financing from the exporter.

Benefits:

- Promotes sales by offering importer financing

- Interest income potential

Drawbacks:

- Risk of importer default on payments

- Resource intensive to manage

Offering credit terms requires thorough evaluation of importers' creditworthiness.

Open account, consignment and trade credit terms favor the importer but leave the exporter exposed. These are best suited for established trade relationships or secured transactions.

Factors to Consider When Selecting Payment Terms

Choosing appropriate terms involves weighing several factors:

Risk Tolerance

- What level of non-payment risk can your business tolerate?

- Are you able to take on the additional risk of open account or consignment terms?

- Do you require the security of cash in advance or letters of credit?

Evaluate your risk appetite and need for payment guarantees.

Costs and Fees

- What are the costs and fees associated with each payment method?

- Who pays - importer or exporter?

- How do costs impact the bottom line?

Wire transfers have higher fees while bank transfers are cheaper. Understand the true cost.

Speed of Payment

- How quickly do you need to receive funds after shipment?

- Is fast settlement with wires critical or can you wait for bank transfers?

- Does the payment term impact your cash flow management?

Factor in timeliness of payment and impact on cash flow.

Importer/Exporter Preferences

- What payment term does the importer prefer?

- Can you align on terms that work for both parties?

- Is the importer creditworthy and established?

Accommodating importer preferences can boost sales potential.

There is no one-size-fits-all solution. Selecting international trade payment terms requires thoroughly evaluating:

- Non-payment risks

- Costs and fees

- Speed of payment

- Importer/exporter preferences

Carefully weigh these factors against your business requirements to identify the ideal payment terms.

Conclusion

Determining the right payment terms is crucial when selling overseas. Companies must balance risk, cost, speed of payment, and importer/exporter preferences.

Key takeaways:

- Cash in advance and letters of credit provide maximum payment security for exporters but may limit sales potential.

- Open account and consignment favor the importer but leave the exporter highly exposed to non-payment.

- Documentary collection and bank transfers offer a middle ground on risk, cost and speed.

- Weigh factors like non-payment risk, fees, and importer relationships when selecting terms.

- Offer a mix of payment options tailored to your target export markets and trading partners.

Carefully evaluate all payment methods to identify the ideal approach, rather than automatically defaulting to cash in advance terms.

In conclusion, the optimal payment terms enable you to:

- Protect against risk

- Minimize costs

- Accommodate customer preferences

- Access new markets

Leveraging the right international trade payment methods provides security while supporting business growth and sales. Here is a 7 question FAQ for the article on international trade payment methods:

Frequently Asked Questions

Q: What are the main payment methods used in international trade?

A: The top payment methods are cash in advance, letters of credit, documentary collection, open account, consignment, and wire/bank transfers.

Q: Which payment terms pose the least risk for exporters?

A: Cash in advance and letters of credit offer the most secure terms for exporters, virtually eliminating the risk of non-payment.

Q: When are open account terms appropriate in international trade?

A: Open account terms carry high risks for the exporter but may be suitable for established trading relationships with importers that have strong credit.

Q: What are the benefits of payment by letter of credit?

A: Letters of credit provide security for both exporters and importers by having a bank guarantee payment. Exporters know they will be paid if LC terms are met.

Q: How can exporters accommodate importer preferences for payment terms?

A: By offering a mix of payment options like cash in advance, LCs, documentary collection, and open account, exporters can align with importer needs.

Q: What fees are typically associated with international trade payment methods?

A: Fees vary but may include charges for wire transfers, letters of credit, documentary collection, and trade financing. Compare total costs.

Q: How can payment terms impact new market access?

A: By offering attractive terms like open account or consignment, exporters may gain opportunities in new overseas markets that would otherwise be hard to enter.

https://www.youtube.com/watch?v=cIM5SdLI58g